Old Town Belton Redevelopment

The Old Town Belton Redevelopment Plan (pursuant to Chapter 353) is an incentive policy that grants real property tax abatement in exchange for substantial property improvements. Substantial property improvements include but are not limited to driveway and sidewalk work, a new roof, new siding, new windows, etc. Improvements must elevate the appearance and structures of the applicant's property as a whole.

All projects must be approved by the Old Town Belton Redevelopment Corporation (OTBRC) Board and City Council prior to the start of any repairs or construction associated with the scope of work.

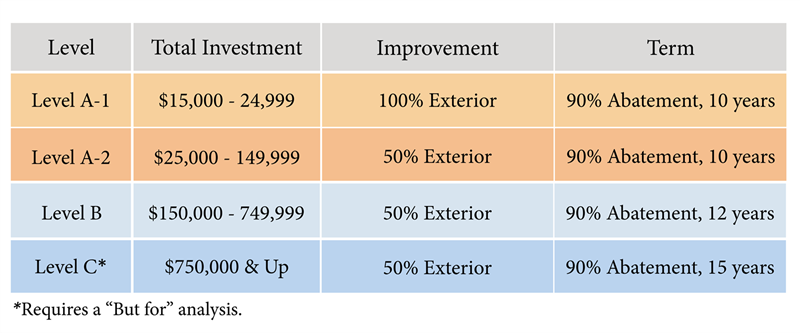

Approved projects are eligible for 90% real property tax abatement for up to 15 years or the cost of improvements, whichever comes first. Each level has a different investment threshold, guidelines and abatement value. Real property tax abatement is trigger after the approved project is complete.

Process Overview

- Property owner submits a completed application for approval and pays the city a filing fee ($250 filing fee for investment Level “A” or $750 filing fee for investment Level “B” and “C”. Any projects that are not approved by the City Council will have the filing fee refunded.) A completed application includes a detailed list of improvements with associated costs, copy of property deed and supporting documents.

- City staff reviews application to determine whether the proposed project complies with the city’s adopted Old Town Belton Redevelopment Plan and Old Town Belton Redevelopment Plan Policy.

- Old Town Belton Redevelopment Corporation (OTBRC) Board of Directors reviews the application. If the OTBRC Board recommends approval, the application will go before City Council. A public hearing is held at the City Council meeting for the taxing jurisdictions. If City Council approves (or approval with conditions) the application, the OTBR Plan will be amended via an ordinance to authorize the tax abatement for the project.

- Once approved the property owner is able to begin with project implementation.

- Once the property owner completes their project, receipts and invoices must be submit for work performed to city staff for review and certification of costs. Once city staff verifies work was performed and completed in accordance with the approved project and approves certification of costs, city staff can initiate tax abatement.

- Beginning in the year of the property transfer, the County Collector bills the property owner for taxes due (e.g., land only portion of taxes are still due during the first 10 years of abatement) and payments in lieu of taxes (“PILOTS”) pursuant to the terms of the Memorandum of Understanding agreement in the amount of taxes that would have been due on the previously existing improvements to the property if no tax abatement had been granted the County Collector collects the taxes and PILOTS by December 31 of each year and distributes them to each of the taxing districts.

- City staff tracks tax abatement for 10-15 years (depending on level of tax abatement approved) or until costs of improvements have been recouped through tax abatement, whichever occurs first.

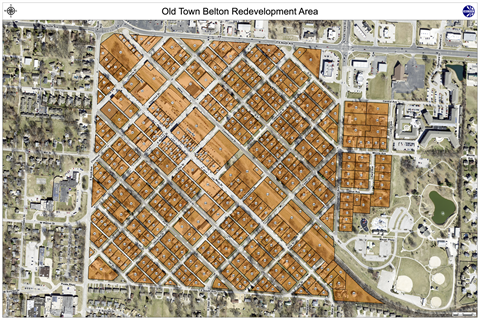

Old Town Belton Redevelopment District Map(PDF, 24MB)

Old Town Belton Redevelopment Application(PDF, 258KB)

Old Town Belton Redevelopment Flyer(PDF, 25MB)(PDF, 25MB)

Full Redevelopment Process(PDF, 58KB)

Old Town Belton Redevelopment Plan Policy(PDF, 183KB)

For more information, please contact economicdev@belton.org or (816)892.1263